One Person Company

As per the Companies Act, 2013 an One Person Company (OPC) is an unique entity where an individual can form a company. It combines the concept of a company with limited liability and succession, allowing a person to own and operate a company in their name. Prior to the implementation of the Companies Act of 2013 only two people could form a company. The Companies Act of 2013 supports the formation of One Person Company (OPC) in India. It governs the registration and functioning of one person company in India. In comparison with a public company a private company should have at least two directors and two members however on the contrary, one person company registration allows any group of people to be incorporated. As per the Section 262 of Companies Act of 2013 and official registration of OPC in India is legal. One person company registration in India requires a single director and a single member representing the whole firm. This corporation type has very few compliance requirements in comparison with a private corporation.

Pricing

StarterPlan

Perfect for initiating company registration.

₹1499 ₹999

What's included:

- Expert assisted process

- Your company name is reserved in just 2 - 4 days

- DSC in just 4 - 7 days

- Incorporation Certificate

- Company PAN + TAN

- DIN for directors

StandardPlan

7 Day company registration process

₹2999 ₹1499

What's included:

- Expert assisted process

- Your company name is reserved in just 2 - 4 days

- DSC in just 4 - 7 days

- Incorporation Certificate

- Company PAN + TAN

- DIN for directors

- Zero balance current account with up to 7% interest

- GST Registration Free

- Digital welcome kit that includes a checklist of all post-incorporation compliances

- ADT 1 & INC 20A form filing

Fast TrackPlan

7 Day comprehensive package

₹34,899 ₹21,999

What's included:

- Dedicated account manager

- Your company name is reserved in just 24 hours

- DSC in just 24 hours Free

- SPICe+ form filling in 7 days

- Incorporation Certificate

- Company PAN + TAN

- DIN for Directors

- Zero balance current account with up to 7% interest

- GST Registration Free

- Accounting & Bookkeeping (Up to 100 transactions)

- ADT 1, INC 20A, AOC 4 & MGT 7 form filing

- Annual filing(Up to turnover of 20 lakhs)

- GST Filing(Up to turnover of 20 lakhs)

- Digital welcome kit that includes a checklist of all post-incorporation compliances

- 30-minute call with a senior CA/CS for your business planning

Note: Govt. fees and taxes are not included in the prices

Documents Required for OPC Registration

● Identity and Address Proof

● Scanned copy of PAN card or passport (foreign nationals & NRIs)

● Scanned copy of voter ID/passport/driving

● Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

● Scanned passport-sized photograph specimen signature (blank document with signature directors only)

● Registered Office Proof

● Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

● Scanned copy of notarised rental agreement in English

● Scanned copy of no-objection certificate from the property owner

● Scanned copy of sale deed/property deed in English (in case of owned property)

Advantages Of OPC Company in India

● Legal Standing

● Easy Access to Funding

● Less Conformity

● Easy Integration

● Easy to Manage

● Constant Repetition

Checklist for One Person Company Registration

● Maximum and minimum membership requirements must be met

● There should be a nominee chosen before incorporation

● Use Form INC-3 to request the nominee's approval

● The Companies (Incorporation Rules) 2014 mandate that the OPC name be selected

● Minimum authorized capital of ₹1 Lakh

● DSC of the potential director

● Evidence of the OPC's registered office

Restrictions on One Person Company

Despite having major advantages, one person company registration also comes with a certain set of restrictions.

Not Apt for Scalability

Registering your business as an OPC is a perfect option for a small business structure.

However, if you are planning to scale it up on greater levels then this might not work. At any given time the total number of people in an OPC is always one. If you are planning to add more members and have more shareholders you cannot register your business as OPC. So OPC registration is not apt to raise further capital. This will inhibit the expansion and growth of businesses.

Higher Restrictions on Business Activities As per the rules and regulations, OPC is not permitted to conduct non-banking financial investment activities. Registering yourself as an OPC will not provide freedom to invest in the security of other corporations.

No Clear Distinction Between Ownership and Management

Since the one-person company has a single person to act as both the director of the company and the management there is no clear distinction between both roles. A single person is permitted to take and approve all the decisions. So, there are higher chances of unethical practices

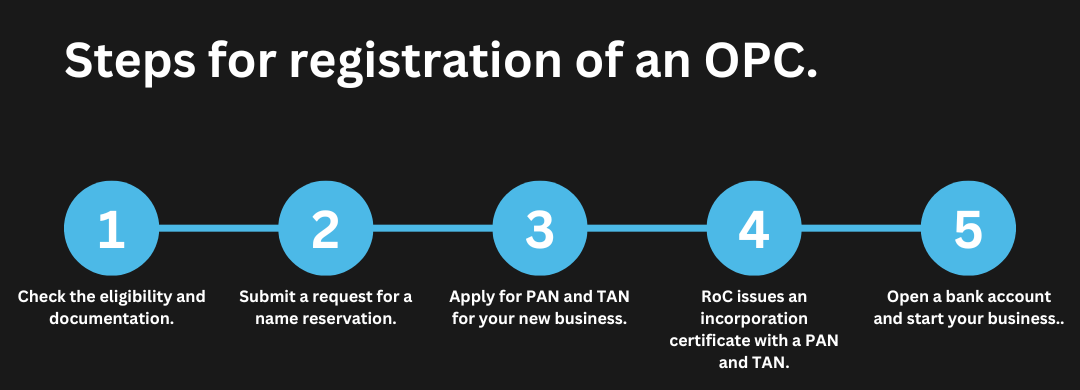

Registration Package for One Person Company in India

● Registration package provides a Digital Signature Certificate online for one of your director's

● We will also provide a Directors Identification Number (DIN) (If the shareholders are different from directors, then additional DSC is required for shareholders)

● Our Business experts will provide assistance with deciding the company name

● PAN and TAN, drafting the articles of association, paying the government stamp duty and the certificate of incorporation fee, obtaining the name approval certificate, and registering for GST, PF, ESI, and PT (only applicable in Maharashtra) will be done with utmost care and speed

● A Zero balance current account will be opened in DBS or ICICI